Workday Financial Management: Revolutionizing Financial Operations for Modern Enterprises

In this blog post, we will explore how Workday Financial Management is reshaping the way businesses manage their financial processes, improve decision-making, and foster growth. This comprehensive look will highlight Workday’s core capabilities, its key products for financial management, and how these solutions help organizations streamline operations and drive better outcomes.

The Evolving Landscape of Financial Management

The role of finance has significantly evolved from being a mere support function to a strategic pillar of business decision-making. Traditional finance departments focused primarily on accounting, budgeting, and compliance. However, today’s CFOs and finance teams are tasked with a broader remit, including driving operational efficiency, optimizing working capital, managing risk, and enabling data-driven decision-making.

Enterprises now require systems that not only ensure regulatory compliance but also enable real-time insights into financial health, drive automation in financial processes, and provide tools for scenario planning and forecasting. This is where Workday Financial Management steps in.

What is Workday Financial Management?

Workday Financial Management is a comprehensive suite of applications designed to integrate all aspects of finance into a single platform. It provides organizations with a unified solution that ensures accurate financial reporting, improves operational efficiency, and offers deep insights into performance. The suite leverages cloud technology, artificial intelligence (AI), machine learning (ML), and real-time analytics to create an adaptable and scalable financial management environment.

Workday Financial Management offers a full range of capabilities that span across accounting, financial planning, reporting, procurement, and much more. By automating and streamlining core financial processes, businesses can increase operational visibility, reduce costs, and improve decision-making capabilities.

Key Features and Benefits of Workday Financial Management

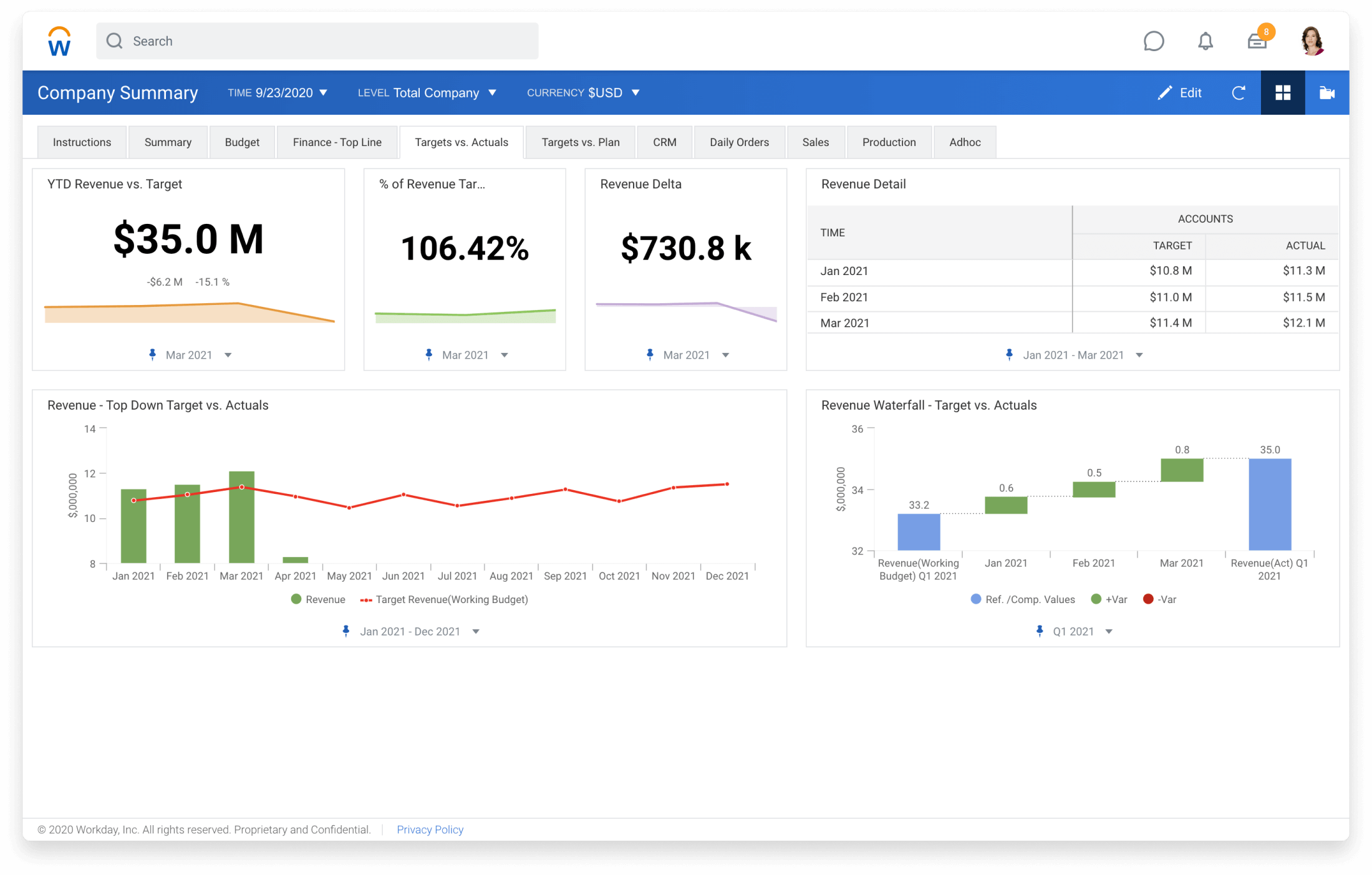

- Real-Time Financial Reporting and Analytics: Workday’s platform provides up-to-date financial data across the organization. This enables decision-makers to access accurate, real-time information about cash flow, revenue, expenses, and profitability. With integrated reporting tools, Workday allows finance teams to run customized reports and dashboards that can reflect financial data from various departments, ensuring holistic insights for effective decision-making.

- Scalable and Flexible General Ledger: The Workday General Ledger is flexible, enabling businesses to easily adapt to changing financial needs, whether it’s across different regions, departments, or business units. It ensures a consistent and accurate view of financial transactions while supporting detailed hierarchies and multi-dimensional analysis.

- Automated Financial Processes: Workday uses automation to handle tasks such as invoicing, billing, journal entries, and account reconciliations. Automation reduces manual intervention, minimizes human error, and frees up time for finance teams to focus on higher-value activities such as strategy and analysis.

- Intelligent Procurement: Workday Financial Management includes a comprehensive procurement module that enables businesses to manage their procurement process efficiently. It integrates with supply chain and sourcing tools to automate purchasing workflows, ensuring better visibility into spending patterns, cost-saving opportunities, and contract compliance.

- Global Financial Management: Organizations that operate in multiple countries or regions need a financial system that supports global operations while complying with local regulations and accounting standards. Workday Financial Management provides multi-currency, multi-tax, and multi-GAAP capabilities, allowing businesses to seamlessly handle complex international financial transactions.

- Continuous Planning and Budgeting: Workday Financial Management comes with a flexible and collaborative budgeting and planning tool that enables continuous updates to financial forecasts based on changing conditions. This dynamic approach to financial planning ensures that organizations remain agile in the face of market changes and can make more accurate predictions for the future.

- Seamless Integration: As businesses deploy multiple tools for different functions such as HR, procurement, and project management, integration becomes critical. Workday Financial Management provides seamless integration with other Workday applications and third-party systems. This ensures consistency in financial data and eliminates the need for manual reconciliation across platforms.

Key Products in Workday Financial Management Suite

Workday Financial Management is built on a unified platform that includes a variety of products to address specific needs in financial operations. Below are the primary components of the Workday Financial Management suite:

Workday Accounting Center

Workday Accounting Center is designed to centralize and simplify accounting operations by automating the processing of journal entries, facilitating accurate reporting, and ensuring timely close periods. The platform provides enhanced visibility into financial transactions and helps streamline accounting tasks, such as general ledger maintenance and reconciliations. The automation capabilities reduce the need for manual data entry, improving efficiency and reducing errors.

Workday Adaptive Planning

Workday Adaptive Planning offers comprehensive planning, budgeting, and forecasting capabilities. It allows finance teams to create and adjust budgets with real-time input, enabling them to make strategic decisions faster. The platform uses AI and ML to predict future financial trends based on historical data, which can inform better business strategies. By providing a single platform for finance, HR, and operations data, Workday Adaptive Planning aligns all departments on common financial goals.

Workday Financial Management for Procurement

This solution integrates procurement processes directly into the broader financial ecosystem, allowing businesses to track expenses and manage supplier relationships more effectively. Through automation, procurement workflows become more efficient, reducing the administrative burden while ensuring better control over expenses. Workday’s solution also provides insights into spending patterns, helping organizations negotiate better terms with suppliers and uncover cost-saving opportunities.

Workday Spend Management

Workday Spend Management offers a comprehensive approach to managing expenses, improving the accuracy of budgeting, and providing better control over company spending. The solution integrates with procurement, accounts payable, and expense management systems to provide detailed, real-time insights into expenditure. The platform also features automated approval workflows and integrates with budgeting and planning tools to ensure all spending remains within financial targets.

Workday Reporting and Analytics

Workday offers a suite of reporting and analytics tools that help finance teams create customized reports and gain insights into financial performance. The platform allows users to track key metrics such as revenue, expenses, profitability, and return on investment (ROI) across departments and business units. Workday’s reporting tools are powered by a centralized data model, ensuring consistent and accurate information.

Workday Treasury Management

Workday Treasury Management is designed to optimize cash flow and liquidity management by offering real-time insights into cash positions and forecasted cash needs. The system automates processes related to cash movements, ensuring that organizations can manage their liquidity efficiently and make informed investment decisions. With integrated risk management and compliance features, Workday Treasury Management also helps reduce exposure to financial risks.

How Workday Financial Management Drives Value for Businesses

- Enhanced Financial Visibility and Control: Workday provides a centralized view of financial data, empowering finance teams to track expenses, revenues, and cash flow in real-time. With advanced reporting tools, companies can generate accurate financial statements quickly, while continuous monitoring helps identify inefficiencies or discrepancies in the system before they become major problems.

- Faster Decision-Making: With Workday, finance teams can analyze financial data in real-time, making it easier to spot trends, address issues promptly, and adjust forecasts. This enhances the speed and accuracy of decision-making. Real-time dashboards and financial reports help executives and managers at all levels make informed, data-driven decisions that can improve profitability and operational efficiency.

- Cost Savings and Operational Efficiency: By automating routine processes such as invoicing, expense tracking, and budget allocations, Workday helps organizations cut down on manual tasks and the associated risks of human error. The elimination of paper-based systems and the reduction in administrative burden directly contribute to cost savings. Moreover, streamlined procurement workflows result in better supplier relationships and optimized spending.

- Scalability and Flexibility: Workday Financial Management is built to scale as businesses grow. Whether an organization is expanding into new regions or adding business units, Workday’s adaptable solutions can handle the complexity of global financial operations. With Workday, businesses can manage multi-currency transactions, comply with regional tax regulations, and handle financial data in various formats, all on a single platform.

- Better Compliance and Risk Management: Workday’s comprehensive reporting tools and built-in compliance features ensure that businesses can maintain compliance with regulatory requirements, such as tax laws, accounting standards, and industry-specific regulations. The platform also supports audit trails, internal controls, and financial governance, minimizing the risk of fraud or financial misreporting.

Why Choose Workday Financial Management?

Organizations that choose Workday Financial Management benefit from its unified cloud platform, which integrates key business functions and provides a more holistic view of organizational performance. Workday’s solutions are built for the cloud, meaning they offer scalability, security, and continuous updates. With a focus on ease of use, intuitive interfaces, and user-friendly design, Workday ensures that finance teams can quickly adopt the system and begin using it effectively.

Additionally, Workday provides ongoing support and training to help businesses maximize the value of their financial management solutions. With a commitment to innovation, Workday continually enhances its offerings to ensure organizations are equipped to tackle the challenges of tomorrow’s financial landscape.

If your organization needs help with Workday Financial Management, Workday Consulting Services, or any other related Workday services, consider working with a trusted partner like us. We specialize in Workday Integration Services to seamlessly connect your systems, and we also offer Workday Recruiting Services to ensure you find the right talent for your organization’s needs.

Conclusion

Workday Financial Management offers a powerful, scalable solution for businesses looking to streamline their financial operations, gain real-time insights, and drive data-informed decisions. By integrating core financial processes—such as accounting, procurement, planning, and reporting—into a single platform, Workday empowers organizations to reduce costs, improve visibility, and foster better decision-making at every level.

For finance leaders, adopting Workday means embracing a modern, flexible, and AI-driven approach to financial management that aligns with the fast-paced needs of today’s global economy. With its robust suite of products, Workday provides the tools necessary for businesses to maintain financial health, meet compliance requirements, and position themselves for growth in the digital age.

Contact us

Please complete the form below, and one of our Engagement Managers will contact you within one business day.